This handbook is developed in cooperation with industry partners and DNV.

It provides a guideline on how to manage decarbonization in a structured way.

Our intention is to provide a guideline on how to manage decarbonization in a structured way.

This handbook explores what you can do with the asset you have – and with technology that is available today.

Drivers for decarbonization

Just like any other industry, shipping is having an impact on the world around it, and we need to cut the industry’s emissions drastically to achieve the climate ambitions of the Paris agreement.

and policies

from cargo

owners

investors and

capital

The decarbonization of shipping will be driven forward by external factors: regulations and policies, access to investors and capital, and expectations from cargo owners

These three key drivers can incentivize decarbonization in different ways. Regulations and policies will place direct requirements on ships and shipping companies. Expectations from cargo owners, and access to investors and capital, will benefit environmentally friendly shipping, for example, through higher chartering fees, or access to low-cost financing.

Behind all three drivers is the more climate-conscious behavior affecting the way people act as consumers, voters, and investors, caused by the increased public awareness of climate change.

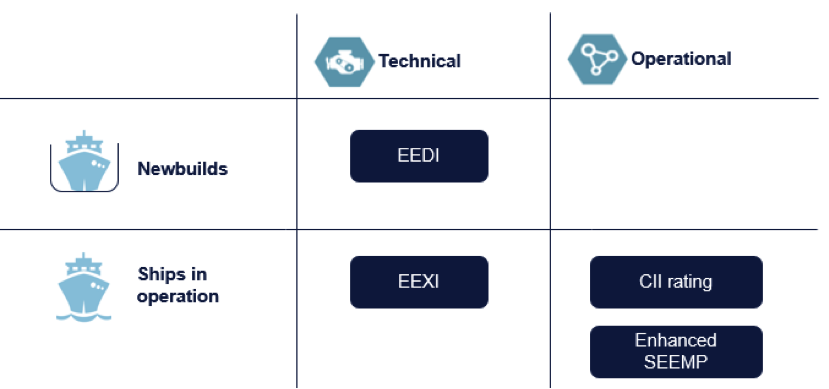

Regulations to come

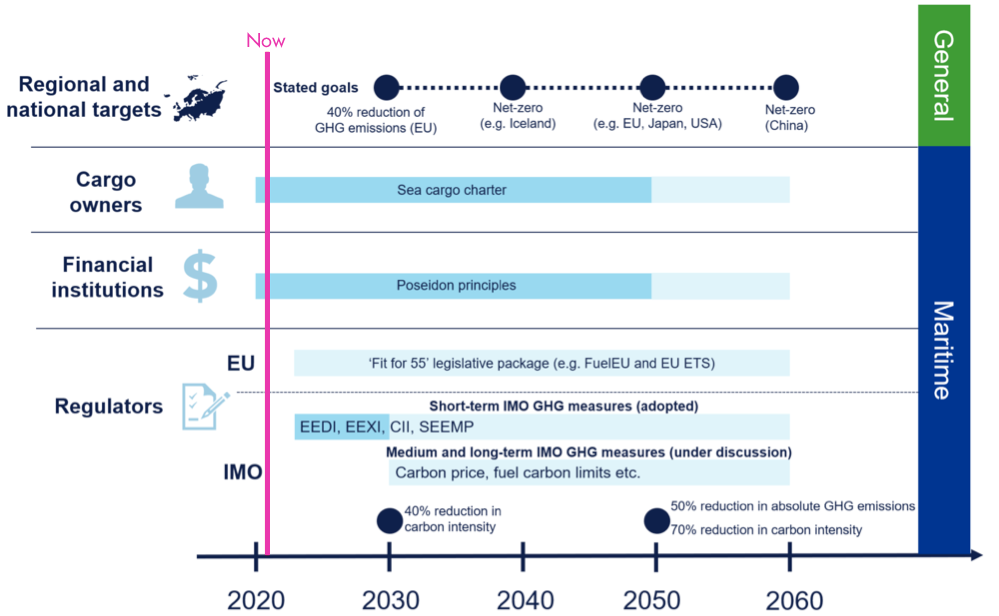

Government policies such as regulations remain a key driver for decarbonization, imposing direct requirements on ships and shipping companies.

The most influential regulator for shipping is the IMO, with its concrete ambitions of at least halving absolute GHG emissions by 2050 compared with in 2008, in addition to reducing carbon intensity by 70%. National and regional regulators are also entering the scene increasingly.

Information on each requirement

Technology space

What will be tomorrows energy carrier? How does the different energy forms compare and how much can we reduce the emissions with technology that is already available today?

Several new energy carriers and new propulsion systems are currently being developed and tested for shipping. We can, however, reduce the CO2 emissions significantly by using technology that we have available today, in combination with operational measures.

Operational and technical measures

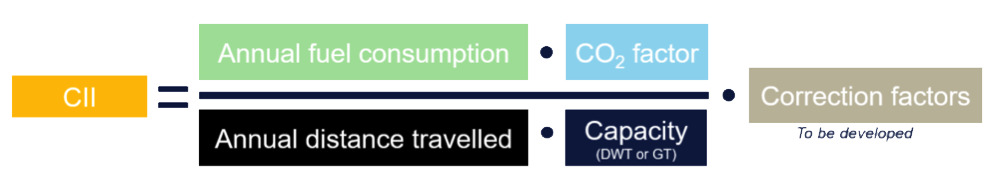

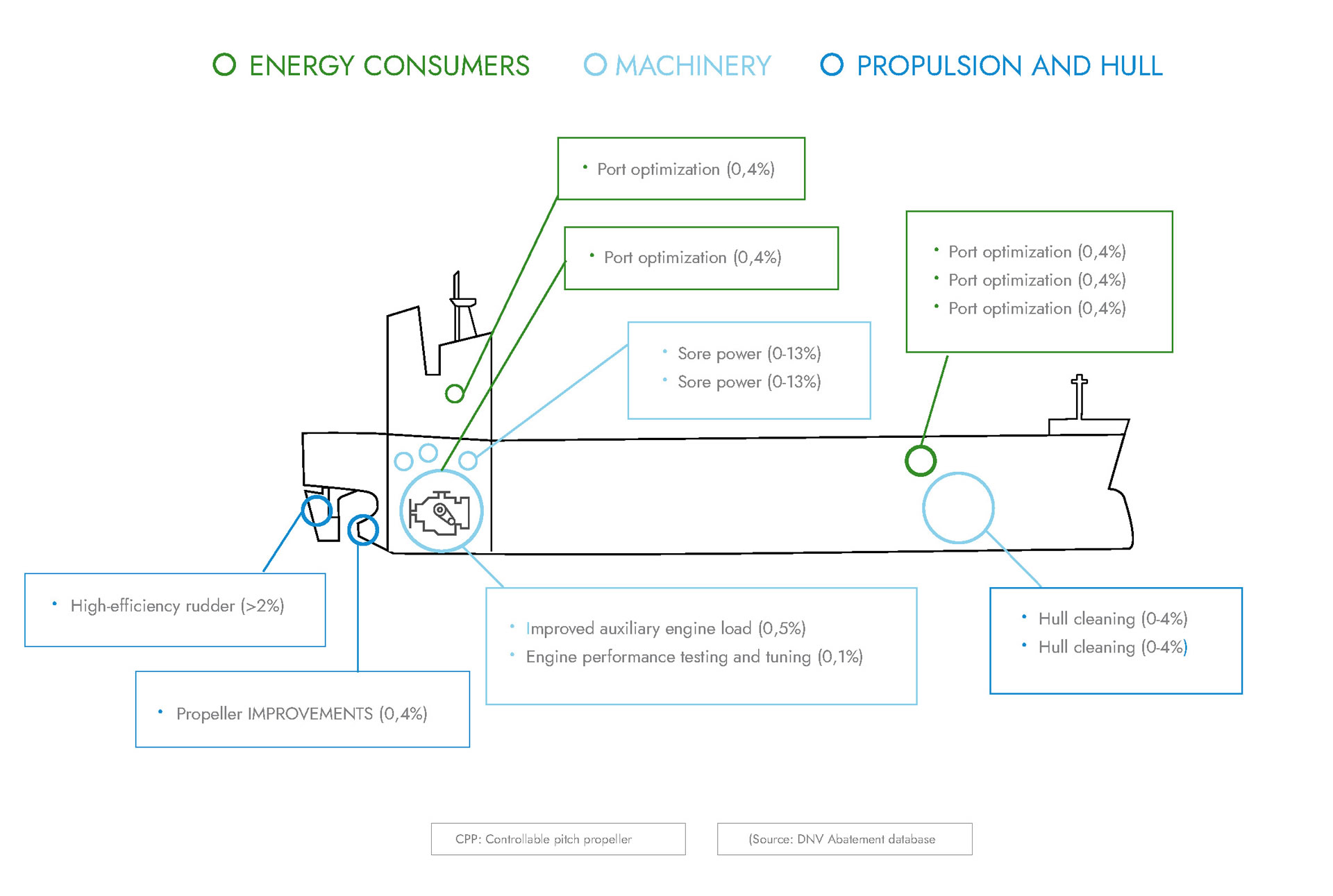

Technical measures

Technical measures generally aim to either reduce the power requirement of the engines or to improve fuel efficiency. Such improvements can be achieved by reducing propulsion energy demand (e.g., hull and propeller efficiency); improving energy production (e.g., waste-heat recovery and machinery-system optimization); and by reducing the energy use of other onboard consumers (e.g., cargo-handling systems, deck machinery, lighting system).

Technical measures generally, have a substantial investment cost and potentially very significant emission-reduction effects. Some technical measures are limited to application on new ships, due to high costs or inapplicable retrofitting.

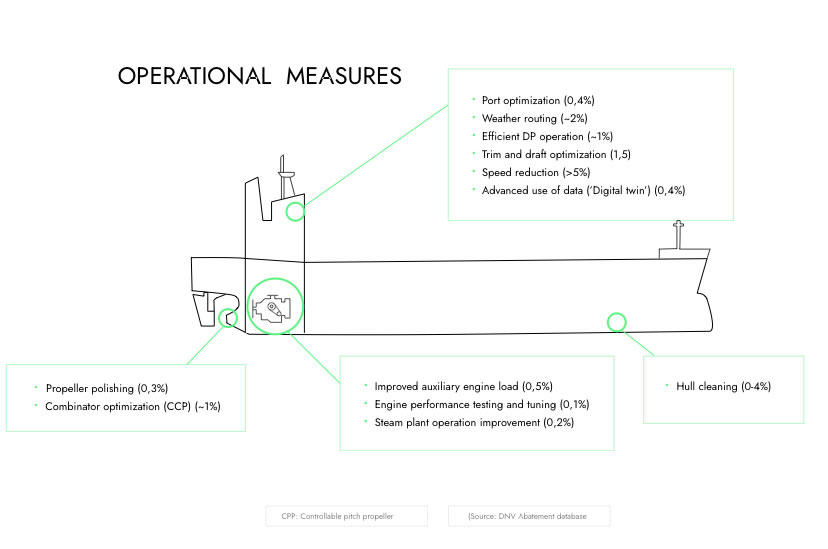

Operational measures

Operational measures relate to how ship is operated and maintained. They include measures such as optimized trim and draft, hull and propeller cleaning, better engine maintenance, and optimized weather routing and scheduling.

In contrast to technical measures, operational measures typically do not require significant investment in hardware and equipment. Implementation of many of these measures is attractive for purely economic reasons, as well as for cutting emissions.

By cleaning the ships hull once a year, we can save up to 30 tons of CO2-emissions every single day

Options for reducing greenhouse gas emissions from a ship

Energy-efficiency measures

Technical measures, operational measures.

> 5%

Alternative fuel technologies

Hydrogen, Ammonia, Methane, Diesel, Methanol, Batteri eletric.

0 – 100%

Harvesting energy from the surroundings

WInd energy, Wave energy, Solar energy.

< 30%

After-treatment measure

Carbon capturing and storage (CCS) > 30%

Barriers to uptake of alternative fuels

Indicative status of key barriers for selected alternative fuels (based on DNV GL, 2020b)

energy density

Wind energy

More than 10 ships are operating with sails today, and several projects are underway, with the Flettner rotor being the leading technology.

Sails will not replace the main propulsion system completely on ships, but it can, however, give a large add-on effect. Depending on factors such as sail arrangements, ship type, and wind conditions, savings can typically range between 3% to 15% for the main engine consumption. Some ships have even reported a 25 % reduction over time for rotor sails.

GHG emissions

Whether the future is hydrogen, ammonia or battery, roto sails, combined with any of those fuel sources, will be the best solution”

Framework

Different financial, commercial, and regulatory drivers move shipping towards decarbonization. This, in combination with an uncertain future technology space, means that shipowners today face a complex carbon-risk picture.

Ships were previously designed considering aspects such as technical performance, demand for seaborne transportation, earnings, oil prices and fuel consumption. Today’s shipowner must, to a much larger extent, also factor in the sustainability, GHG aspects, and technology developments to ensure that the ship is prepared for the future. The ship must comply with implemented and planned regulations, and efforts must also be made to ensure it remains competitive in a future where sustainability and GHG performance are closely linked to both market and financial risks.

DNV has previously presented structured and knowledge-based approaches to manage uncertainty related to decarbonization of ships. Building on this work, DNV present a three-step framework for managing decarbonization risk that can be applied to both newbuilds and existing vessels.